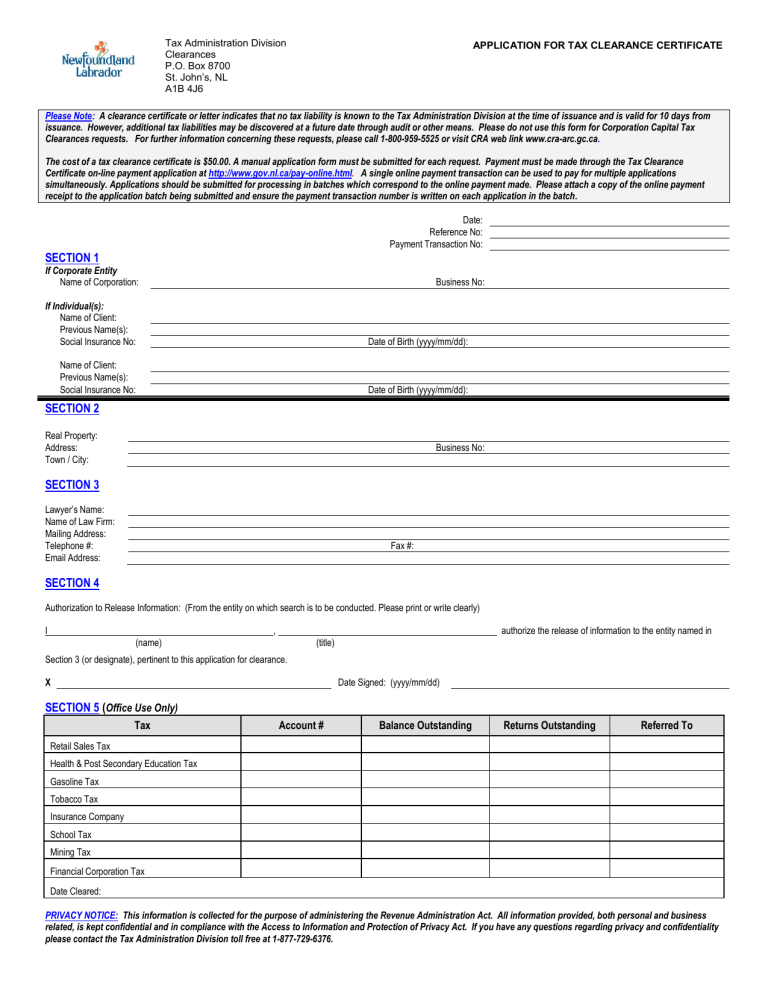

Application For Tax Clearance Certificate : Sworn Application For Tax Clearance Fill Out And Sign Printable Pdf Template Signnow. How to submit the completed form asking for a clearance certificate (tx19, gst352) you can submit the completed request by mail, fax, or online using the submit documents feature on my account for individuals, represent a client, and my business account. For each property, provide the complete address, including county, date of acquisition and nature of property (residential, industrial, acreage, commercial or farmland). Form year form published ; A tax clearance certificate is issued by the department of taxation to certify that the taxpayer named on the certificate is compliant with the tax laws of hawaii (title 14, hawaii revised statutes).this means the taxpayer has filed all required tax returns and paid or has an active payment plan to settle all liabilities (including fees, penalties, and interest) due as of the date the. Official website of the kansas department of revenue.

A tax clearance certificate is issued by the department of taxation to certify that the taxpayer named on the certificate is compliant with the tax laws of hawaii (title 14, hawaii revised statutes).this means the taxpayer has filed all required tax returns and paid or has an active payment plan to settle all liabilities (including fees, penalties, and interest) due as of the date the. Please provide the following information to help us confirm your identity. All tax clearance requests must be submitted using the online application. This section outlines how you can apply for a tax clearance certificate. For each property, provide the complete address, including county, date of acquisition and nature of property (residential, industrial, acreage, commercial or farmland).

It certifies that a business or individual has met their tax obligations as of a certain date.

This section outlines how you can apply for a tax clearance certificate. The original application was filed. Applicants are advised to submit applications for certificates at least 4 working days in advance of the date on which they require such certificate. Please provide the following information to help us confirm your identity. The electronic tax clearance (etc) system All tax clearance requests must be submitted using the online application. Create date october 14, 2020. Request a tax clearance certificate for sales, withholding, corporate, net worth, individual income, motor fuel, and exempt organization unrelated business taxable income with the department of revenue online through georgia tax center. You must complete an application for tax clearance form and submit it to one of the inland revenue offices listed in the next section. To receive certificate of compliance or a clearance letter you must have an account to collect and/or report tax with the department and the requester's name must be listed on sunbiz.org showing association with the company. A tax clearance certificate verifies the entity satisfied all tax obligations due to the commonwealth, including taxes, interest, penalties, fees, charges and any other liabilities. Last updated february 2, 2021. See general information for details.

This means there are no outstanding debt or other obligations to the tax authority in the jurisdiction in which you are operating. Tax clearance submit request begin the process of requesting a new tax clearance view status view the status of a previously submitted request for tax clearance verify certificate verify the authenticity of a tax clearance certificate or confirmation number The application must be signed by a corporate officer. Official website of the kansas department of revenue. How to generate a tax clearance certificate.

If application is for a bulk sale clearance certificate, attach a list of pa properties that will be retained.

Applicants are advised to submit applications for certificates at least 4 working days in advance of the date on which they require such certificate. A tax clearance certificate is confirmation from revenue that your tax affairs are in order. If the requester is not a corporate officer or registered agent, they. Application for tax clearance (foreign company). A tax clearance certificate is issued by the department of taxation to certify that the taxpayer named on the certificate is compliant with the tax laws of hawaii (title 14, hawaii revised statutes).this means the taxpayer has filed all required tax returns and paid or has an active payment plan to settle all liabilities (including fees, penalties, and interest) due as of the date the. For best results, download and open this form in adobe reader. Tax compliance status (tcs) replaced the tax clearance certificate system which was previously used by sars. Tax clearance requests may be denied if the request is incomplete or incorrect information provided. To get a certificate you must complete an application for a department of revenue clearance certificate. See general information for details. The application must be signed by a corporate officer. This means there are no outstanding debt or other obligations to the tax authority in the jurisdiction in which you are operating. Your tax compliance status is not static as it changes in line with your tax behaviour, and can impact your business.

For each property, provide the complete address, including county, date of acquisition and nature of property (residential, industrial, acreage, commercial or farmland). To receive certificate of compliance or a clearance letter you must have an account to collect and/or report tax with the department and the requester's name must be listed on sunbiz.org showing association with the company. For best results, download and open this form in adobe reader. Apply for tax clearance online using etax clearance (etc) the etc service allows you to apply for a tax clearance certificate online. If application is for a bulk sale clearance certificate, attach a list of pa properties that will be retained.

A tax clearance certificate is required when tendering for government business contracts, and when seeking citizenship, residency, and the extension of work permits.

Contact the tax commission to request tax clearance application. A tax compliance, otherwise known as a tax clearance certificate is an official document issued by kra, as proof of having filed and paid all your taxes. A tax clearance certificate is issued by the department of taxation to certify that the taxpayer named on the certificate is compliant with the tax laws of hawaii (title 14, hawaii revised statutes).this means the taxpayer has filed all required tax returns and paid or has an active payment plan to settle all liabilities (including fees, penalties, and interest) due as of the date the. A tax clearance certificate is required when tendering for government business contracts, and when seeking citizenship, residency, and the extension of work permits. Form year form published ; Request a tax clearance letter. Applicants are advised to submit applications for certificates at least 4 working days in advance of the date on which they require such certificate. If application is for a bulk sale clearance certificate, attach a list of pa properties that will be retained. This means there are no outstanding debt or other obligations to the tax authority in the jurisdiction in which you are operating. A tax clearance certificate is confirmation from revenue that your tax affairs are in order at the date of issue. While all canada revenue agency web content is accessible, we also provide our forms and. Instructions for filing tax returns can be found on the form procedure for dissolution, withdrawal or surrender. How to generate a tax clearance certificate.